Lastly, debtors should be mindful of the lender's popularity and customer support track report.

Lastly, debtors should be mindful of the lender's popularity and customer support track report. Reading reviews and in search of suggestions can provide insight into the reliability and transparency of a lender, making certain that borrowers don't encounter surprising challenges post-loan fund

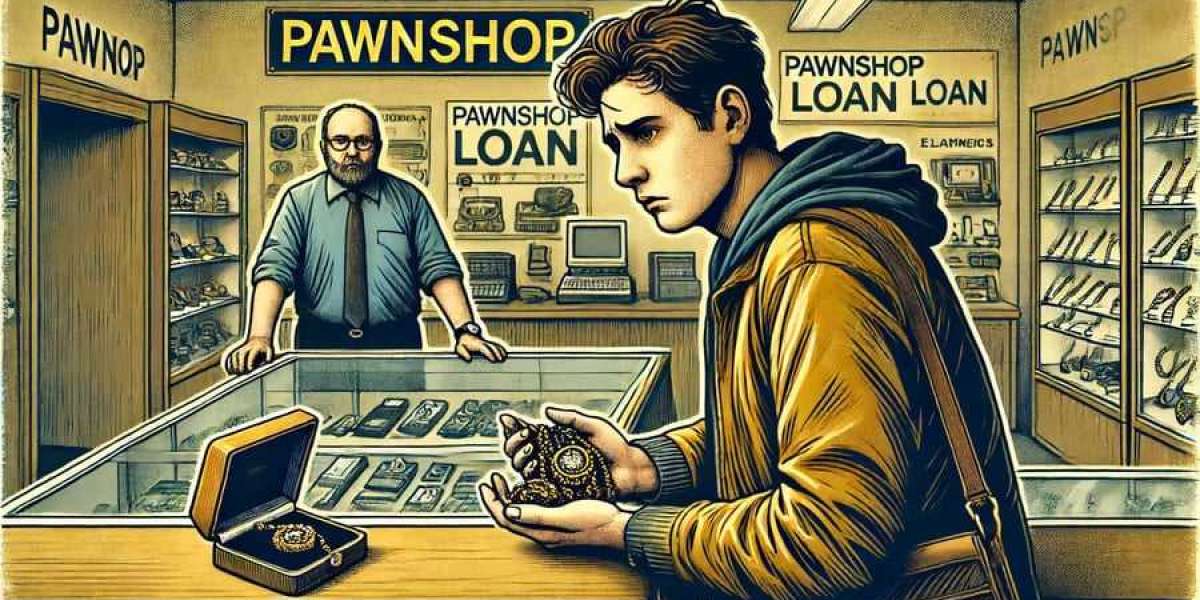

One of the necessary thing options of pawnshop loans is that they do not require a credit examine. This makes them accessible to a wider vary of individuals, together with those with poor credit histories. After the loan is issued, the borrower has a set period, usually 30 days, to repay the loan along with interest. If the mortgage is repaid on time, the borrower gets their item again. If not, the pawnshop has the right to sell the merchandise to get well the mortgage amo

By leaning on skilled insights and consumer experiences, Bepec empowers individuals to select the proper pawnshop for their needs. From understanding rates of interest to choosing the correct collateral, Bepec serves as a useful resource that simplifies the complexities of pawnshop lo

Once all necessary information is provided,

이지론 lenders will evaluation the application and make a decision based on the applicant's creditworthiness and monetary scenario. If approved, the borrower will receive a loan offer outlining the terms, including interest rates and compensation schedules. Accepting the offer usually requires an electronic signature, which might often be accomplished with only a few cli

Disadvantages of Pawnshop Loans

Despite their advantages, pawnshop loans also come with several disadvantages. One main concern is the interest rates, which may be considerably greater than standard loans. Borrowers may discover themselves trapped in a cycle of debt if they cannot repay the mortgage inside the designated timeframe, resulting in larger pri

Importance of Financial Education

Financial education plays a pivotal role in the Bankruptcy Recovery journey. Gaining information about financial management, investment strategies, and credit score scores can significantly empower individuals who have experienced chapter. The understanding of fundamental monetary principles can prevent future pitfalls and reduce the chance of falling again into monetary difficult

You can pawn quite a lot of objects, together with jewellery, electronics, musical devices, and luxurious handbags. The key's that the merchandise should maintain vital value and be in good condition for it to be accepted as collateral for a mortg

n The restoration process varies for everybody, relying on particular person circumstances. While the chapter itself may final a couple of months, rebuilding credit score and establishing new monetary habits can take a number of years. Consistent effort and adherence to a sound financial plan are key to rushing up restorat

Consolidation is another viable methodology where a number of money owed may be mixed right into a single mortgage with a decrease rate of interest. This simplification can not only ease the month-to-month payment course of but in addition reduce the burden of coping with numerous collectors. However, people contemplating consolidation should thoroughly analysis and choose reputable lenders to avoid potential predat

Common Misconceptions About Pawnshop Loans

Pawnshop loans typically include misconceptions that may mislead potential borrowers. A widespread myth is that pawnshops are only for folks in determined monetary situations. In reality, many individuals use pawnshop loans as a sensible financial answer somewhat than a last resort. People may leverage these loans to handle money flow while awaiting payments from different sources, corresponding to freelance w

How to Choose a Reputable

Pawnshop Loan When in search of a pawnshop mortgage, it is essential to choose on a reputable and trustworthy pawnshop to ensure a clean expertise. Start by researching local pawnshops, looking for established businesses with optimistic buyer reviews. It's additionally useful to compare several retailers to get a sense of their provides and circumstan

No-visit loans can be suitable for many people however may not be the best suited choice for everybody. They are inclined to favor those who need quick access to funds and will not be perfect for big monetary commitments. It's essential to gauge your monetary scenario, credit history, and the terms of the mortgage to discover out if this type of lending aligns together with your ne

When you reach an agreement on the mortgage amount, the pawnbroker will offer you a contract outlining the terms, including the loan quantity, rates of interest, and repayment interval. Ensure you perceive all aspects of the settlement earlier than proceeding, as this will safeguard towards future misunderstandi

Additionally, 베픽 regularly updates its content to reflect the most recent tendencies and regulations in cellular lending. This dedication to offering correct and well timed information makes it an important vacation spot for anybody considering cell lo